Veteran Saves Week Is Happening November 12 - 15.

Organizations: Sign up to participate in the national call-to-action to encourage Veterans, transitioning servicemembers, and their families or caregivers to do a financial check-in to get a clear view of their finances.

A Financially Confident You Begins Here.

One thing veterans have in common is the experience of unique financial opportunities and challenges. On your journey to becoming more financially stable, having a trusted resource and community that meets you where you are and gives practical, easy-to-implement tips and strategies is a complete game changer. Enter Veteran Saves: your savings accountability partner. Join our community for support with saving successfully, reducing debt, building wealth, and more.

Take the Veteran Saves pledge

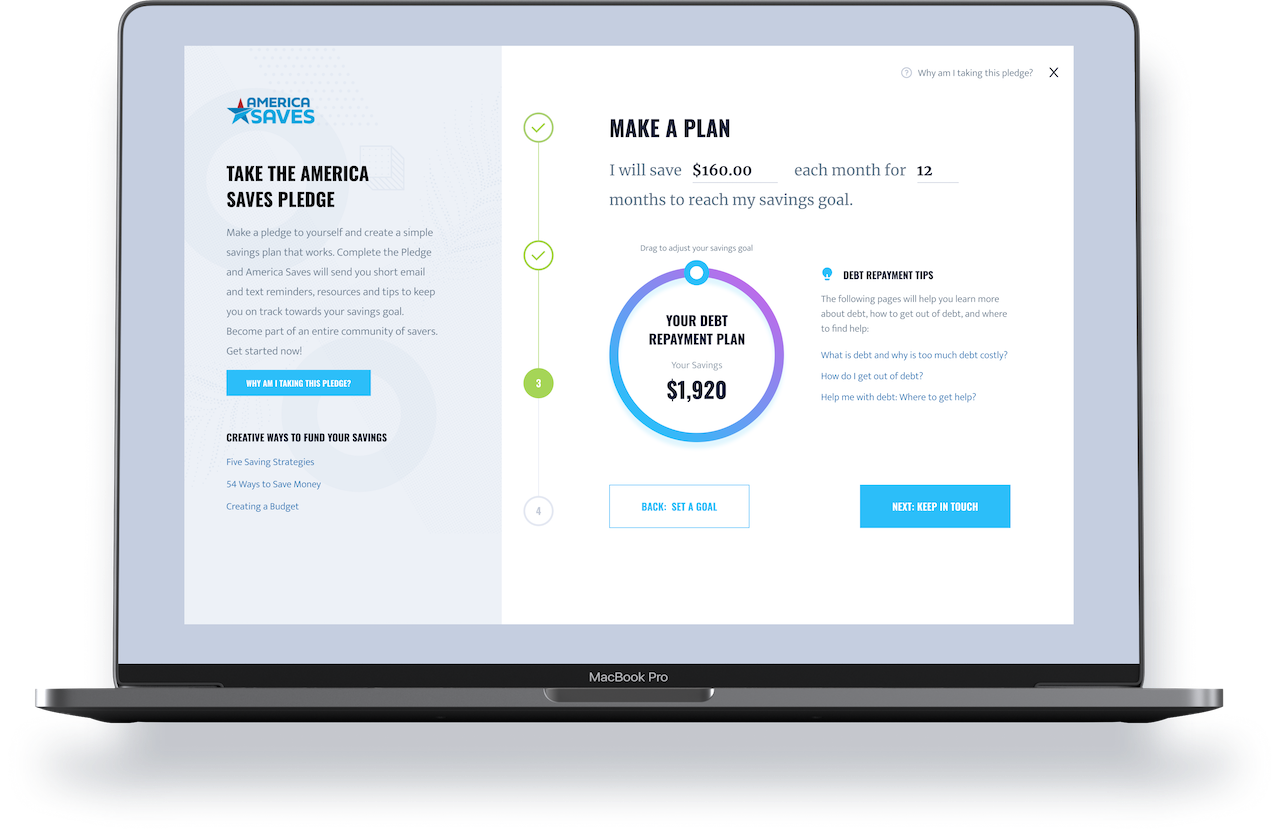

Make a pledge to yourself and create a simple savings plan that works. Complete the Pledge and Veteran Saves will send you short email and text reminders, resources and tips to keep you on track towards your savings goal. Become part of an entire community of savers. Get started now!

creative ways to fund your savings

Those with a savings plan are twice as likely to save successfully. Taking the Veteran Saves Pledge is a pledge to yourself to start a savings journey and Veteran Saves is here to encourage you along the way. Take the first step toward creating a better financial future. Make a plan, set a goal, and pledge to yourself to start saving, today.

Congrats on completing the pledge!

We are so glad you have started your savings journey and Veteran Saves will be right beside you the whole way! You will soon receive an email from the America Saves team to help encourage you. Find helpful links below to continue researching topics on saving.

WHAT ARE YOU SAVING FOR?

Think about your most important financial goal right now. Then choose a topic below to explore resources available to support you in making a plan to achieve your goal.

Do you have a saving tip or story you want to share with us?

If we feature you in our newsletter, you get $50.

TAKE THE VETERAN SAVES PLEDGE

Make a pledge to yourself and create a simple savings plan that works. Complete the Pledge and Veteran Saves will send you short email and text reminders, resources, and tips to keep you on track toward your savings goal. Become part of an entire community of savers. Get started now!

Take the Veteran Saves pledge

Make a pledge to yourself and create a simple savings plan that works. Complete the Pledge and Veteran Saves will send you short email and text reminders, resources and tips to keep you on track towards your savings goal. Become part of an entire community of savers. Get started now!

creative ways to fund your savings

Those with a savings plan are twice as likely to save successfully. Taking the Veteran Saves Pledge is a pledge to yourself to start a savings journey and Veteran Saves is here to encourage you along the way. Take the first step toward creating a better financial future. Make a plan, set a goal, and pledge to yourself to start saving, today.

Congrats on completing the pledge!

We are so glad you have started your savings journey and Veteran Saves will be right beside you the whole way! You will soon receive an email from the America Saves team to help encourage you. Find helpful links below to continue researching topics on saving.

Savings Insights

06.26.2024 By Krystel Spell

Understanding Your Pay Stub: Transitioning from LES to Civilian Pay

In the military, you were accustomed to receiving a Leave and Earnings Statement (LES), which detailed your pay, allowances, deductions, and other financial information each month. As you transition to civilian life, it's important to understand how to read and interpret your civilian pay stub, which serves a similar purpose. Here’s a guide to help you navigate this important document:

03.06.2024 By Krystel Spell (2024), Amelia Simons (2022) & Breanna Johnston, AFC® Candidate (2021)

TIPS TO HELP VETERANS REDUCE DEBT AND PAY IT OFF FOR GOOD

Debt is a significant factor contributing to financial stress among Americans, and veterans are no exception. Transitioning from active service to civilian life brings its own set of financial challenges, including managing debt. A considerable number of veterans find themselves grappling with financial burdens post-service, but it's important to remember—you are not alone in this struggle

02.22.2024 By Krystel Spell

Saving for Events

Transitioning from military to civilian life brings about significant milestones, from transitioning into civilian careers to retirement and more. These milestones deserve celebration, not only to honor the dedication and hard work behind them but also to unite family and friends in joy and excitement. However, celebrations can strain budgets, particularly for transitioning service members and veterans.

02.12.2024 By Krystel Spell

Money Saving Travel Tips for Service Veterans

Traveling is an amazing experience, but it can be expensive. However, transitioning service members and eligible Veterans have access to resources and perks that can help them fulfill their travel dreams and make the most of their vacation without overspending.

02.05.2024 By Kia McCallister-Young

VA Home Buying Process for Veterans

As a veteran, you have access to the VA loan which can help you purchase a home with favorable loan terms and at a rate of interest that is typically lower than conventional loans. Here are the steps to follow when buying a home with a VA-backed loan:

11.07.2023 By Amy Miller, AFC®

10 Cheap or Free Holiday Activities

It’s the most wonderful time of the year! The holidays are one of the happiest seasons for many of us….and can quickly become the most costly. On average, Americans spend around $1800 on gifts, travel, food, and events from November – January each year.

09.01.2023 By AAFMAA

Saving for Major Milestones

Major milestones — events that mark a turning point in your life — often require additional expenses or signify a change in your financial circumstances. To avoid any issues, you should anticipate how milestones will impact your bottom line and create a plan to deal with those additional costs. In fact, saving for major milestones is a sound strategy to include in your overall financial planning.

08.16.2023 By AAFMAA

How to Save for an Emergency

One thing all Veterans have in common is knowing how to be prepared for unexpected events. Sometimes, being prepared means having enough cash on hand to get you through any adverse situation without resorting to loans or incurring credit card debt — whether it be an unexpected (and expensive) car repair or medical bills or even a natural disaster. Having an emergency fund is essential to your preparedness for facing life’s financial surprises head-on.

06.21.2023 By AAFMAA

Legacy Planning — It’s for Everyone

There is a common misconception that legacy planning is for the extremely wealthy. But what is “wealthy?” Everyone's assessment of what constitutes wealth is different, and everyone has their own version of what it means to leave a legacy behind.

By Krystel Spell

6 Money Saving Reasons You Should Use the VA Loan When Buying A Home

The VA loan program is a great benefit of military service that provides many money saving options and empowers Veterans to achieve their dreams of homeownership.

Our Partners

06.07.2024 By Walmart

Walmart

Our goal is to support veterans and military families during their service and beyond. That’s how we’ve built a culture where veterans feel they belong, with benefits for their well-being and an understanding that the skills gained in service can transfer to any job out there.

04.24.2023 By VBBP

Veterans Benefits Banking Program (VBBP)

Veterans and their beneficiaries have more options for receiving VA benefits via direct deposit, as well as access to financial services at participating banks and credit unions.

FOLLOW VETERAN SAVES ON SOCIAL!

Veteran Saves is a program of America Saves and sister program to Military Saves. Our mission is to increases the financial confidence and well-being of American Veterans and transitioning service members so that they can save successfully, reduce debt, and build wealth.

Join the Movement! Receive News and Updates

Sign up here to receive:

- partner resource packets every other month to help you communicate with the public, constituents, and other organizations

- latest research and news from the campaign

- other occasional updates and opportunities